The first step in choosing any given career path is to ascertain that you have the necessary aptitude for the desired role. As with any role, skills and information can be learned and acquired, yet the necessary outlook and character traits must be present to hope for fulfilment and success in the chosen vocation.

The first step in choosing any given career path is to ascertain that you have the necessary aptitude for the desired role. As with any role, skills and information can be learned and acquired, yet the necessary outlook and character traits must be present to hope for fulfilment and success in the chosen vocation.

Perhaps the most important character trait required to become a great mortgage broker is a fundamental commitment to be of service and assist others in achieving their financial goals. If one targets the career of a mortgage broker solely for the expected high levels of reimbursement without consideration for the service that must be offered, then perhaps the career of a home based day trader may be more suitable. A great mortgage broker will be adept at ushering often-nervous clientele through the steps to make the biggest purchase of their lives. The gravity of which must not be forgotten, even by the most experienced broker.

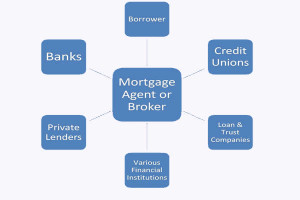

Other aptitudes will be necessary to make a great mortgage broker, including an ability to network and maintain relationships with a wide variety of clients, service providers, banks, mortgage wholesalers and lending aggregates.

You must be personable and be able to put a client at ease and reassure nervous clients about the appropriate actions to take given their position and financial aspirations.

Become a Mortgage Broker 2015 edition

Many mortgage brokers come from a background within the financial industry and have often worked for one of the Big Four banks or some other lending institution prior to striking out on their own and setting up as a mortgage broker.

What Does A Mortgage Broker Do?

It is important for anyone who is interested in pursuing a career as a mortgage broker understands what the day-to-day duties will entail.

It is important for anyone who is interested in pursuing a career as a mortgage broker understands what the day-to-day duties will entail.

Being able to effectively research, compare and evaluate the best loan products according to a specific clients needs would make up a majority of what a mortgage broker does.

Having the ability to manage all of the minutiae of multiple mortgage applications is essential to being an effective mortgage broker. Strong administration and organisational skills will ensure that each client is served in a timely and efficient manner.

Most of all being able to juggle a variety of roles that make up being a mortgage broker effectively is very important is being a great mortgage broker.

What Qualifications Are Required?

The level of education for becoming a qualified mortgage broker is surprisingly low considering the high levels of recompense garnered in the profession. In comparison with other similar earning professions such as a chartered accountant, the minimum qualification a mortgage broker requires is only a Certificate IV in Finance and Mortgage Broking. It should be noted that this is a minimum requirement to practice and that registration with FBAA (Finance Brokers Association of Australia) has this listed as the minimum level of education required to become a practicing mortgage broker. The MBAA (Mortgage Brokers Association of Australia) require the minimum qualification level of a Diploma of Finance.

Mortgage Broking Associations

As previously mentioned there are two peak bodies in Australia that deal primarily with the Mortgage Broking industry and act as unified bodies to ensure fair treatment of their members and ensure ethical practice is undertaken by each and every member of the association. It is impossible to practice as a mortgage broker in Australia without membership with one of these associations. Each association has particular levels of practice that can be delivered under the guidelines of membership depending on the level of qualification the member has and the amount of time spent in the lending industry and experience that member has.

In addition to joining an association, a newly minted mortgage broker must also gain an Australian Credit Licence or ACL through ASIC (Australian Securities & Investments Commission). This credit licence ensures that the broker has operated ethically in the past and is free from indictment for financial misconduct and is not bankrupt, nor a criminal.

Benefits Of Being A Mortgage Broker

Perhaps the most commonly cited benefit of being a mortgage broker is the high level of remuneration that a mortgage broker can expect to garner from their activities. As previously stated the average earnings for an Australian Mortgage Broker rivals that of a CPA, yet has much less study required to practice.

The second benefit is that of being able to work ones own hours – assuming of course that you are an independent broker. Much of the work can be completed from home – in particular the research component of the job is easily possible wherever there may be Wi-Fi connection. Meetings with clients can be conducted in their own home, which may set many potential customers at ease and eliminates the need for a dedicated office space – also reducing overheads for a fledgling business.

The most important benefit of being a mortgage broker in Australia echoes the opening paragraph of this article. It is the personal satisfaction gained from helping people navigate the often bewildering world of modern mortgage finance and ensure that each and every client that you service comes away with the best possible mortgage deal for their circumstances. If you genuinely want to assist others in attaining their financial aspirations then no reward can compare with helping someone in purchasing their dream home.